Pay off mortgage early calculator lump sum

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly. If you used a 10000 lump sum to pay down your mortgage youd shave off 10 monthsand 13500 in interestfrom your original payment plan.

How To Calculate Loan Payments And Costs Nextadvisor With Time

You can pay more than your normal repayments off your mortgage with an extra monthly payment or a lump sum payment or both.

. With Lump Sum Payment. You decide to make an additional 300 payment toward principal every month to pay off your home. Making a lump sum payment particularly.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. The financial services organization TIAA says the final payoff usually includes at least 10 extra days of interest and a date through which this sum is sufficient. Months to Pay Off.

By making a lump sum payment you will repay your loan 58 months earlier and. It will save you 37564 in total interest charges. Excellent Credit Good Credit Fair Credit.

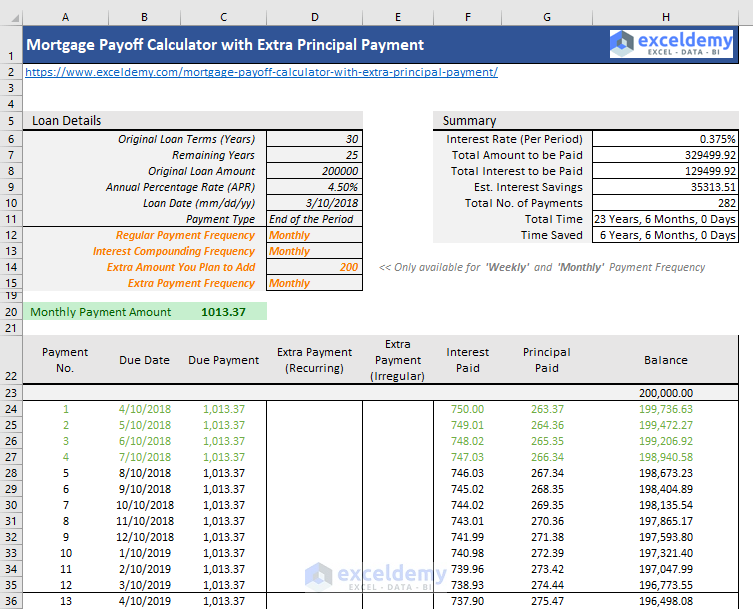

Up to five recurring or up to ten one-time lump sum payments. Youll save a total of 3489061 on interest charges and youll pay off your loan within 23 years and 6 months. Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost.

New Look At Your Financial Strategy. Mortgage drawing date or the first date you took the loan Once you have all the above information simply enter it into the calculator. Find A Dedicated Financial Advisor.

Visit The Official Edward Jones Site. Extra mortgage payments calculator If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you. Want to pay off your mortgage earlier or reduce your monthly payments.

Over 30-years would require you to make additional payments of. If you add 50 on your bi-weekly payments you can pay off your loan in 25 years and 5 months. You can get a lump sum after receiving inheritance benefits or a windfall from a business venture.

Download our free guide Is a Lump Sum Pension Withdrawal Right for You. Finally if you add 150 on your bi-weekly. Ad Learn the alternatives to your pension plan.

10 Best Mortgage Lenders In 2022 - Get Rates Apply Easily - Compare Current Rates. However if you make a regular overpayment of 50 from the start of your mortgage you can pay your mortgage in 23 years and 3 months. Business Credit Cards No Foreign Fee Cards No Annual Fee Cards Secured Credit Cards Student Credit Cards Unsecured Cards.

Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. With just 200 per month you removed 6 years and two months off your. According to the Monevator mortgage calculator youd pay 1122 a month give or take a Mars Bar.

Early Payoff Calculator Whether its your student loan car loan or mortgage you can pay it off faster and save money in interest by making more than the minimum payment. Lets Partner Through All Of It. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

Much like extra repayments a lump sum payment can have a significant impact on the life of your home loan and the amount of money you can save. Lets say you can bring your. It immediately reduces your principal compared to diminishing it in monthly increments.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. This mortgage payoff calculator can help you find out. Find A Great Lender Today.

The calculator will then generate an. Ad Biggest Mistakes In Mortgage - Steps To Pay Off Your Mortgage - FREE Mortgage Strategies. Get your free guide today.

Early Mortgage Payoff Calculator The following calculator makes it easy for homeowners to see how quickly they will pay off their house by making additional monthly payments on their loan. You may also enter extra lump sum and pre. PAYE calculator on lump sum payment.

Own your home sooner by paying more off your mortgage. How Much Interest Can You Save By Increasing Your Mortgage Payment. How Much Interest Can You Save By Increasing Your Mortgage Payment.

The total interest costs will be 8452679. Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan. Our calculator also handles over-payments.

Its Never Been A More Affordable Time To Open A Mortgage. Ad Life Is For Living. Making extra payments early in the loan.

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Pay Off Mortgage Vs Invest Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

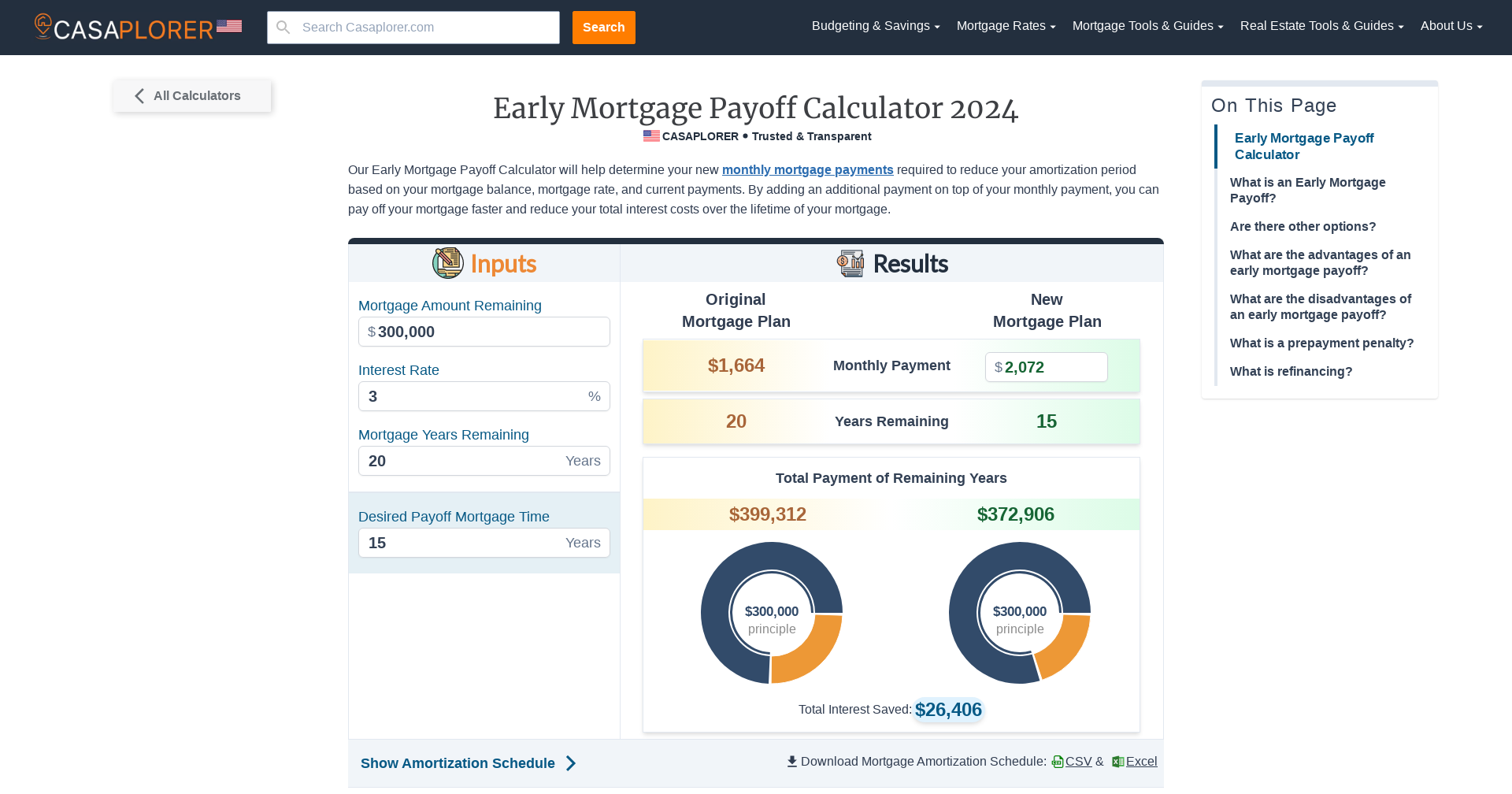

Early Mortgage Payoff Calculator 2022 Payoff Your Mortgage Early Casaplorer

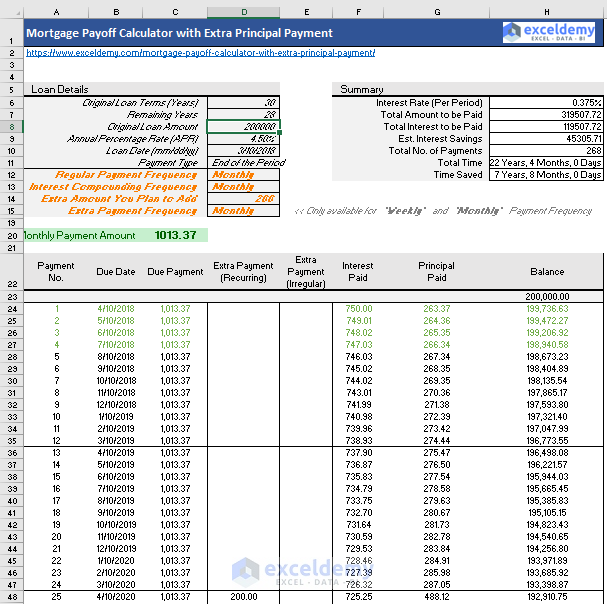

Mortgage Payoff Calculator With Extra Principal Payment Free Template

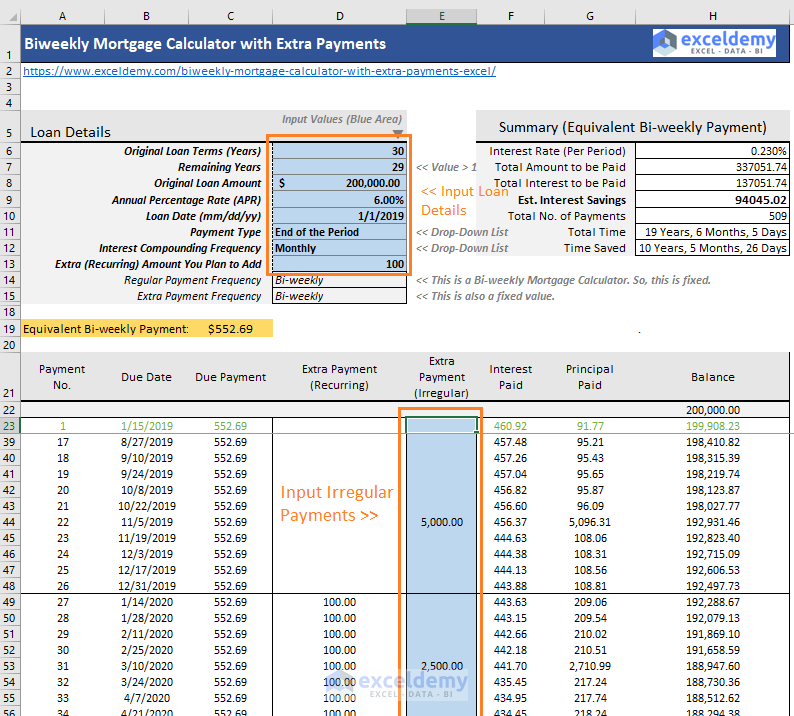

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

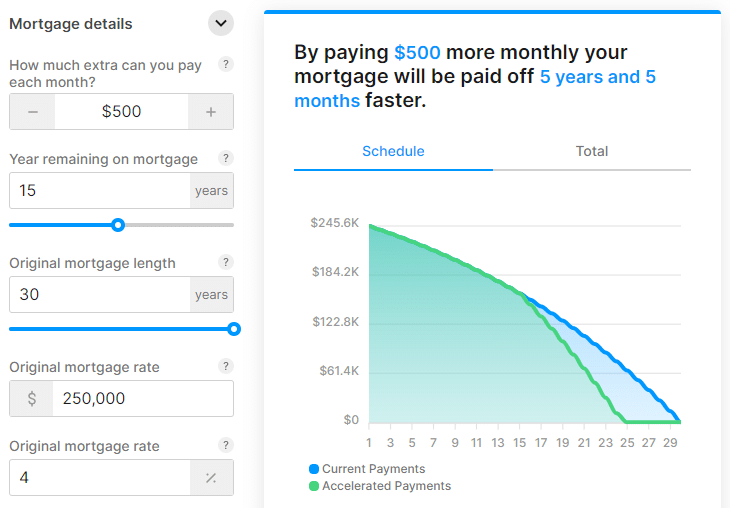

Mortgage Payoff Calculator The Home Loan Expert

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

Oc Payoff Mortgage Early Calculator R Dataisbeautiful

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Mortgage With Extra Payments Calculator

Extra Payment Calculator Is It The Right Thing To Do

How To Calculate Your Mortgage Payoff

Early Loan Payoff Calculator To Calculate Extra Payment Savings

Mortgage Payoff Calculator With Extra Principal Payment Free Template